For property segment, we provide the following service :

Buying Property

Selling Property

Rent / Lease Property

Managing Property

Contact us for property related issues :

As a foreigner, you must understand the basic rules related to property purchase. As Malaysia is a federation country, all property ( included land ) are governed by individual states NOT federal government. So, cross check with local government from time to time is advisable as policy may change.

All transactions ( new property or subsides property ) or any dealing must be done by licensed Real Estate Agent ( REA ), Probational Estate Agent ( PEA ) or Real Estate Negotiator ( REN ) to protect your own interest. You’ll put yourself at risk for any dealing with non-licensed personals.

MM2H Property

Note !

Foreigner can buy property in Malaysia with / without MM2H.

Foreigner can get a mortgage in Malaysia with / without MM2H.

To understand more about property, please read the below article.

Property is governed by individual state NOT federal government. Cross check with local states government is advisable from time to time.

Not all MM2H agencies are licensed to carry out property related business. The MM2H agent MUST also be a licensed real estate agent / Real Estate Negotiator in order to carry out property related business.

To check if a person is licensed to carry out real estate related business, click here !

BUYING PROPERTY

If you’re looking at property at major cities such as Kuala Lumpur, Penang or Johor Bahru ( JB), we can help you searching for the right property both for your own stay or investment.

Foreigners buying property must comply with local state government’s requirement.

RENT / LEASE

You may wish to rent / lease a place to stay first before buying a property of your own so that you have time to do your research on the property market. We do have a team of real estate negotiators ( REN ) who can help you in finding a right place to stay.

SELLING PROPERTY

Contact us if you want to sell your property in Kuala Lumpur, Penang or JB or any state in Malaysia. Just fill in the form on the above and we will get in touch with you.

Managing Your Property

We do help owner to manage their property in Kuala Lumpur with a small fees starting from MYR150 per month. Talk to us on property type and fees structure.

2026 : Complete Property Buying Guide for Foreigners:

If you (a foreigner) wish to buy property in Malaysia, I believe you need to know some of the important issues related to cost as below :

Property price.

Taxes involve.

Transaction cost.

Legal cost.

Yearly holding cost of your property

Once you understand the above, we will talk about secondary issue on property such as :

Type of property foreigners can buy.

Minimum property price for each Malaysia states.

Property for MM2H and non-MM2H holders.

Getting a home loan as foreigner.

The buying process.

Who’s licensed property agent ?

Property Price

All property purchased by foreigners must be approved by local land office or what usually called Foreign Consent. All states in Malaysia has a minimum purchase threshold for foreigners or even some state do have special package for Malaysia My Second Home, MM2H holders. Please check with your real estate agent for update as rules and regulation may change over time. We will discuss more on these costs in “transaction costs”.

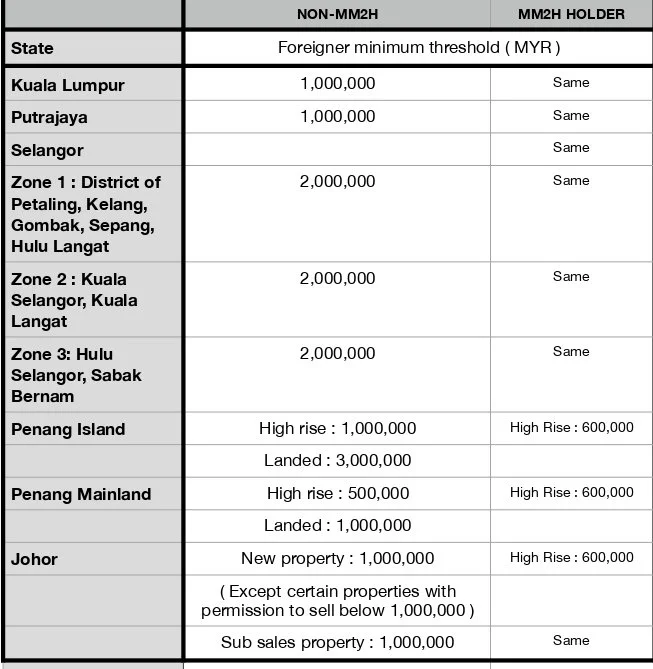

All foreigners can only buy property that meet the minimum threshold set out by the local state government as below :

In most of the states, the minimum purchase price for foreigners are straightforward except Penang and Johor which is a bit complicated.

Please check with us from time to time as policy may change.

Taxes Involved

Buying property not only talking about the property price alone. You also need to consider all taxes or hidden fees on top of property price so that you’re prepared with your budget not getting any surprise later on.

In Malaysia, taxes / levy on property vary according to individual states and also from time to time, these policy may change.

In this section, I will outline all the taxes possible so that you’re prepared.

Most common taxes to be considered are :

MOT ( Memorandum of Transfer ) or sometimes called stamp duty for SPA

Stamp Duty on your loan agreement ( only if you’re taking loan service from a licensed financial institution ).

Legal Fee.

Foreign Consent Fee.

Registration Fee.

Levy

Real Estate Agent Fee.

Let’s look into these taxes / levy individually.

MOT ( Memorandum of Transfer )

Starting 2026, MOT for foreigners is 8%. However this maybe change from time to time especially in October each year when the government table its annual budget. So, watch out each year. MOT apply to both new property or sub-sales ( secondary) property. Talk to us if you with to know more.

Stamp Duty on Loan Service

This is 0.5% from your loan amount ( not property amount ). If you’re buying cash, this doesn’t apply to you.

Legal Fees

This will depend on if you’re buying new property or from secondary market. Very common, if you’re buying new property from developer, they will absorb the legal fees but you must use their lawyer / solicitor in order to enjoy free legal fees.

However if you’re buying from secondary market, legal fees normally range from 1% - 1.5%

Foreign Consent

This depend on individual state. In Kuala Lumpur, it range from MYR3,000 - 4,000. Sometimes some law firm may charge higher.

Foreign Consent fee in Penang is MYR10,000 for residential property and MYR20,000 for commercial property such as service apartment.

In Johor this fee may vary from MYR6,000 and above depend on the value of the property.

Registration Fees

This fees actually cover several registration with different government departments. It may cost MYR3000 in Kuala Lumpur. In certain state for example Johor or Penang, the registration fees may be higher.

Levy

This fees is especially significant in Johor and Penang. Levy fee could be as high as 3% - 5%. You must check with your agent beforehand.

Levy in Johor

Levy fee in Johor depend on if you’re buying from developer or subsides and also if you’re buying commercial property such as service apartment, SOHO, SOVO…( commercial title under HDA ) or pure residential property.

Levy : For commercial title property. A 3% or minimum of MYR30,000 whichever is higher for property above MYR1,000,000 OR MYR50,000 (levy) for property below MYR1,000,000.0 is had been approved by the state government.

For pure residential property the levy is 3% or minimum of MYR30,000 whichever is higher.

Levy in Penang

Levy for landed property and high rise building are different.

For landed property, it is 3%.

For condominium, levy will depend on the value of the property.

Property price below MYR1,000,000.0 the levy is 3%

Property price between MYR1,000,000 - MYR1,500,000 the levy is 3% ( Penang Island ) but 1.5% (Mainland).

Property price above MYR1,500,000, the levy is 3% again.

Agent fees

Talk to your real estate agent before you even start the purchasing process. In certain states, they may charge you 1% - 1.5%

While it is common in Kuala Lumpur and Selangor most agent provide service for free. The fees will be borne by the seller.

Conclusion

All the extra fees above may change from time to time. To know exactly how much you have to pay for this extra fees, please check with your lawyer during purchase time. In General, starting from 2026, you will need to pay all “miscellaneous” extra cost of :

9.5 - 10.5% in Kuala Lumpur

14% - 20% in Johor

14% - 16% in Penang.

Property Annual Holding Cost in Malaysia.

For each property in Malaysia, you will have to pay for the following annual fees. Namely

Management + Sinking fund for all high rise building and all the stratified landed property for the service provided.

This is one of the most expensive in all the holding cost involved. In Kuala Lumpur, it is common to pay MYR 0.35 - 0.6 per square feet (sqf) for ordinary property. For more expensive service apartment, the management and sinking fund may cost from MYR0.6 - 1.0 per sqf. Some luxurious property may start from MYR1.0 psqf onwards.

Assessment : This is paid to the local council. It is paid twice a year. Normally in February and August each year. In Kuala Lumpur, it is range from MYR500 - 1000 for each payment depending on the area and also property price.

Parcel Rent : This is the cheapest in all 3 taxes. It may cost MYR100 - 300 per year in Kuala Lumpur.

Selling Your Property

Please note that, under MM2H policy, you’re suppose to hold your property for a minimum of 10 years before you can sell it, except the following conditions :

You’re terminating your MM2H visa.

You’re buying new property worth more than your first property.

Cost Involve

When you decided to sell your property for whatever reasons, asking price always come first. You may need to take the following criteria into consideration before you decided on the price.

Real Estate Agency fees : Most agent will charge 2% - 3% ( excluding SST ) for their services.

Legal Fees : It could be a few thousands for seller.

RPGT : Real Property Gain Tax. If you may a gain / profit out of the sales, you need to pay tax according to the tax rate. Please be aware that the tax rate may change from time to time especially during the month of October each year when the government announces its annual budget. For foreigners, the tax rate is as below as of 2025:

0-5 years : 30% of the profit gain ( deduct agency fees, legal fees, some of the maintenance or renovation fees )

After 5 years : 10%

Drop us a message !